How to View and Manage Disputes

In this guide, we'll walk you through the process of accessing and managing disputes within your Pabau account.

Understanding Disputes

A dispute, commonly known as a chargeback, arises when a cardholder raises concerns about a payment with their card issuer. Processing a chargeback involves the issuer initiating a formal dispute on the card network, resulting in an immediate reversal of the payment. This action retrieves the payment amount, along with one or more network dispute fees, from Pabau Pay, powered by Stripe. Subsequently, Pabau Pay debits the payment amount and dispute fee from your balance.

NOTE: Pabau and Stripe do not participate in the dispute process and have no influence or control over the final decision. Nonetheless, we are here to assist you through every step of the process.

Accessing Disputes

To view and manage disputes within your Pabau account, you must first ensure that you have the necessary permissions enabled. To do so, navigate to the "Team" section in the left sidebar menu, select "Team" again, and click on the user for whom you wish to enable access to the Wallet feature.

Within the user's profile, go to the "Permissions" tab, expand the "Money" category of permissions, and toggle the "Can access wallet" permission to "on". Save the changes by clicking the "Save Changes" button in the top right corner.

Once you've enabled the Wallet permission, you can access the Wallet feature by clicking on the Wallet icon located in the top right corner of the screen, next to your avatar.

Viewing Disputes

In the Wallet modal, click on "Disputes" on the left-hand side.

On the right side, you'll see a section displaying the number of open disputes and a button labeled "View all disputes".

Click on "View all disputes" to open a new page containing a list of all disputes.

Disputes List

The disputes list comprises a table with the following columns:

Amount: The amount of the disputed transaction.

Status: The current status of the dispute.

Reason: The reason for the dispute (e.g., Fraudulent, Not as described, etc.).

Customer: The email of the customer involved in the dispute.

Source Type: The payment type used for the transaction (with only the last 4 digits of the card number visible).

Disputed On: The country flag and the date when the dispute was initiated.

Respond By: The deadline to respond to the dispute.

Dispute Reasons

-

Canceled: This reason applies when a cardholder cancels or returns merchandise, or cancels services, and the merchant fails to process a credit or void a transaction receipt.

-

Duplicate: This reason covers processing error dispute types, including instances of duplicate transactions, incorrect amounts charged, payments made by other means, and similar errors.

-

Fraudulent: Disputes categorized under this reason indicate that the cardholder's details were compromised, and the transaction was not authorized by the legitimate cardholder.

-

Not as Described: When a cardholder receives merchandise or services that do not match what was presented at the time of purchase, or if the received items were damaged or defective, this reason applies.

-

Not Received: This reason is selected when the cardholder participated in the transaction but did not receive the merchandise or services as expected.

-

Other: Any dispute scenario that does not clearly fit into any of the aforementioned categories is categorized under "Other."

Dispute Statuses

The status of a dispute may change based on its progress and resolution. Here are the possible statuses:

- Days to Respond: This status indicates the time frame given to respond to the dispute. This period typically ranges from 7 to 21 days, contingent on the card network's policies. Following the submission of evidence, it is forwarded to the cardholder’s bank, which has a restricted timeframe, usually between 60 to 75 days, to provide a response, with variations based on the card network.

- Deadline Missed: Indicates that the deadline to respond has passed without submission of evidence, resulting in a resolution in favor of the cardholder.

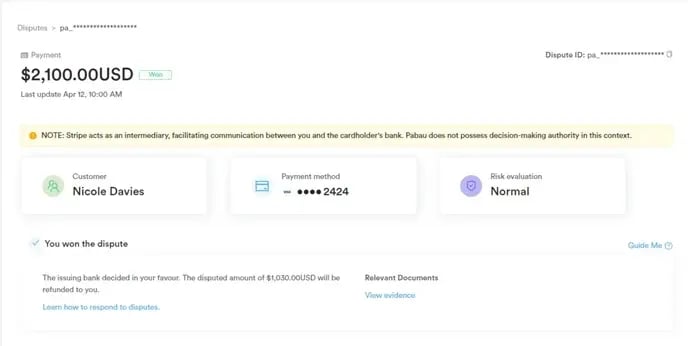

- Won: The dispute was resolved in favor of the merchant, and the disputed amount (minus any applicable fees) is returned.

- Lost: The dispute was resolved in favor of the cardholder, and the disputed amount, along with the dispute fee, will not be returned.

Managing Disputes

You can hover over each dispute status to view relevant explanations. Additionally, the "Won" status contains a link to Stripe's Pricing & Fees webpage for further information.

Dispute Details and Management

In the "This payment was disputed" section, you'll find key dispute details such as the disputed amount, reason, and suggested steps for resolution. At the bottom right corner, you can choose to either Accept Dispute or Counter Dispute, depending on your preferred course of action.

Utilize the "Guide Me" button for recommendations on handling disputes. Click "Next" to proceed to the next page of recommendations or "Skip to dispute details" to bypass the guide and view the dispute details directly.

Beneath the "This payment was disputed" section, you'll find a Timeline displaying changes in dispute status over time.

In the "Checkout Summary" section, you'll find comprehensive client information.

Additionally, details on the payment method, metadata, connections, events, logs, and all activity related to the payment are available for your reference.

Proactive monitoring and addressing of disputes are crucial for maintaining positive customer relations and financial stability.

For more guides, refer to related articles below, select additional guides, or use the search bar at the top of the page. These guides will help you get the most out of your Pabau account.

Additionally, to help you fully utilize and understand your Pabau account, we recommend exploring additional guides and resources offered at the Pabau Academy. It offers in-depth video tutorials and lessons, offering a holistic learning experience that can equip you with the essential skills for achieving success with Pabau.