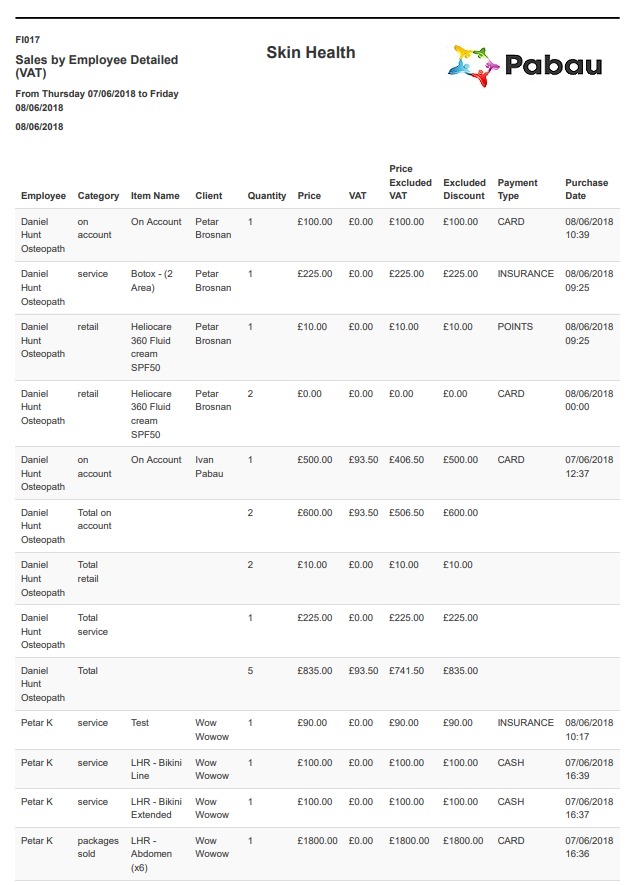

This report will give you a detailed breakdown on your employee with the VAT breakdown.

Additionally, you will have information such as: Employee, Category, Item Name, Client, Quantity, Price, VAT, Price Excluded VAT, Excluded Discount, Payment Type, and Purchase Date.

With this report you will have information about your clients that possess or not possess all of the mentioned above.

Preview

-

Employee - The employee who made the sale.

-

Category - The category of the under which the sold product/service is.

-

Item Name - The name of the item that has been sold.

-

Client - The client who made the purchase.

-

Quantity - The amount sold.

-

Price - The price of the item.

-

VAT - The amount of taxes that would need to be added on top of the item price.

-

Price Excluded VAT - The price with VAT.

-

Excluded Discount - The price without discount.

-

Payment Type - The payment type that the client used.

-

Purchase Date - The date on which the purchase is made.

Did this answer your question?

Did this answer your question?